Who is a trader and where does he work?

In financial markets, a trader is someone who buys and sells stocks, bonds, commodities, and currencies.

Who is that?

A trader, in simple words, can work in a financial institution, where he trades with company money for a salary and bonus. But he can also trade for himself, using his own funds, but also keeping all the profits for himself.

Technical traders focus on charts. They use various indicators and analyze charts looking for buy or sell signals.

Fundamental - focus on fundamental analysis, study corporate events, anticipating earnings reports, mergers and acquisitions, reorganizations that may affect the share price.

Swing traders often hold their positions for more than one day trying to catch a trend. They use technical analysis to find stocks with short-term price momentum.

Commission costs are one of the main disadvantages of short-term trading. However, a number of brokerages offer zero commissions, along with tight market spreads, which makes this problem less of a problem.

Today, trading is available not only to professionals with financial education, but also to ordinary people who see it as a source of additional income and an intellectual challenge.

Nevertheless financial literacy is still essential for a trader's success. A number of trading platforms offer demo modes where you can practice your skills before trading real money.

Financial traders are often criticized and called "vultures" because their success depends on market volatility and random setbacks. While others defend this practice, arguing that it is a fundamental part of the capitalist economy.

Pros and cons of the profession

Traders need to be able to quickly analyze a large amount of information and make informed decisions when the pressure is high. Trading can be very rewarding, but it is also high risk. You can work in a financial institution, trading with bank money or money from bank clients. And you can also work with your own clients advising them on investment opportunities.

This activity offers many ways and opportunities for earning money. The number of available trading instruments is constantly expanding (just remember the emergence of cryptocurrencies and the excitement around them). Moreover, today there is a significant increase in the number and quality of infrastructure services, the number of new market players is constantly growing, not only professionals (for example, investment and hedge funds), but also private investors, which indicates stable prospects for the further development of online trading.

Another important factor accelerating the development of the online trading industry is the continuous improvement of algorithmic trading software.

Summing up this information on online trading, it is safe to say that this occupation is currently one of the most popular types of business on the Internet.

If you work for a company (like a hedge fund or investment bank) as a day trader, hedge fund manager, or quantum trader, you are an employee who is paid a basic forex trader salary and often a performance based commission. Here are some of the benefits of being a hired trader:

- you can use the existing tools and strategies of the company that have already proven their profitability;

- training and mentoring programs are often built into the structure of the company, which means that you receive more support than you could organize yourself;

- you are not risking your own money;

- there is an opportunity for career growth, which means that you can climb the career ladder, and there you can manage more valuable clients and their funds.

There are some disadvantages to being a hired trader:

- if you do not reach the required indicators of the company's profit, you may have to deal with a lot of rules, restrictions;

- there may be office politics or difficult clients to deal with;

- if you do the job well, you can only get a percentage of the profits paid out as a bonus.

If you are an independent forex trader, instead of getting paid, you will invest your money, but also pay yourself with the profit from your own trades. Benefits of working for yourself:

- great flexibility - you can work from anywhere with an Internet connection and trade any time the market is open (this is 24 hours a day, 5 days a week for Forex);

- there are no caps on your income - if there is a profitable strategy, there are no caps on the amount you can earn (assuming there is capital available for trading, of course).

However, as with trading for a company, the independent trader has its drawbacks:

- you are risking your own money, which can lead to higher levels of stress;

- you cannot rely on the base salary, which is automatically paid every month;

- less built-in structure and support than in the company, although there are many educational resources available for traders, but you will need to search for them yourself;

- you need to find or develop your own tools to improve trading efficiency.

How is it different from a broker and an investor?

This profession is similar to that of a broker, but traders usually act on their own behalf, while brokers on behalf of clients, that is the difference.

The main difference between traders and investors is the length of time they hold their assets. Typically, investors are known to hold their investments for a longer period, while traders prefer to profit from shorter trades.

The traditional investor who does not use leverage can get a return of 5-10% per year on their investments. On the other hand, a day trader or swing trader can have a 10% return per month.

Species overview

- Day. The day trader does his job during one trading day. Such an analyst does not participate in long-term trades.

- Scalper. This person makes many (from tens to hundreds) trades every day, trying to make a small profit on each trade. As a rule, the foreign exchange market is involved.

- Medium term. This type of trading differs in the period from a day to several weeks, but no more. Such a trader has the best risk / reward ratio.

- Long term. It is easy to guess that a long-term trader holds a position on a deal for a long time and waits for it to reach the maximum profit. In the long run, you need to have a large bank to withstand the ups and downs.

Responsibility and authority

Day Trader involves analyzing the market and providing detailed market reports to clients or peers:

- he is looking for misvalued assets or other opportunities;

- works to keep people informed of the latest developments and prospects in the markets, working closely with clients and colleagues, building strong working relationships;

- makes a lot of transactions, quickly reacting to the changing financial schedule;

- should strive to attract new customers and provide them with new opportunities.

The main responsibility of a trader is the funds entrusted to him by clients. He is obliged to multiply them, and not vice versa.

Requirements

Not everyone can become a successful trader, for this you have to not only learn a lot, but it is also important to have certain qualities. A successful employee must be a great analyst, otherwise you won't be able to make money.

Personal qualities

Trading is a very demanding job that requires a certain set of skills, as well as the ability to quickly master new data and adapt to an ever-changing environment.

Traders require exceptional analytical skills and the ability to work with large amounts of data. Such a person should be able to communicate with customers and provide detailed advice on market movements and its opportunities.

You need to be able to always take responsibility for your actions, have self-control when quotes go down. Traders need to show a keen interest in the job and learn quickly. Such people must be disciplined and motivated. You will have to make instant decisions without emotion, based on qualitative analysis.

Skills

You don't need to have a bachelor's degree in mathematics or economics to become a trader, but the competition for a job at a large financial institution is fierce. Without a degree from a prestigious university, it will be difficult to find a job in a large company.

In addition, there is always the opportunity to work for yourself, for this there are many platforms on the network. In theory, it is better to have the necessary knowledge in the following areas:

- economy;

- maths;

- finance;

- Accounting.

It is important to know how to work with charts, to have an understanding of the simplest concepts of the financial market. All this can be studied independently from books.

How to become a trader?

Anyone, regardless of age, can undergo independent training in trading from scratch.You should start by reading simple books on the theory of stock trading.

There are online courses on the web that teach the art of trading at home. They are very effective, especially for beginners. You can practice your mistakes with a mentor. Such education will allow a novice trader to take the first steps.

There are many different types of traders and it is worth taking some time to think about which job best suits your skills and interests. Most traders try to work for the company, buying and selling stocks, bonds, assets for investors. Others work for themselves.

Sales agents act as intermediaries between the client and the market, investing their clients' money. They communicate with them directly, advising on market issues and investment opportunities.

The main difference is that traders in this case invest only at the direction of their clients. Some specialize in a particular product or market.

You can try to get a job in a company if you manage to cope with the competition, or you can simply become an independent day trader, trading with your own or also client's money. It is estimated that about 90% of day traders lose money, so you shouldn't think of trading as a way to make quick money. This is a job that requires professional training and extensive knowledge. And you also need a sufficient amount of hardware and software to create your own trading table. You need to be realistic about the possible profit that you want to get, you can't take it lightly.

If a person is just starting to trade, they will need significant capital to move forward. There are no traders making profit all the time, so losses are inevitable and you need to be able to deal with them. The amount of capital that you need will completely depend on the type of trade and how much you want to earn.

It is estimated that a person wanting to work full time as a day trader will need about $ 100,000 to get started. Remember that every trade is a risk, and once a trade starts, these risks need to be managed.

It takes time to develop at least two different trading strategies that you can then apply. You need to have a well-developed plan. It should include information on how to enter and exit the market, what capital to invest, the frequency and value of transactions.

Markets can be volatile. A clear plan is vital, but the ability to read situations and quickly adapt to circumstances is also important. If the strategy stops working, the trader must be ready to adapt it to new conditions or abandon it. Having multiple strategies is very helpful.

To start trading, you need access to the stock market. If you plan to make fewer transactions, choose a separate plan for each transaction with a broker.

The salary

In Russia, a trader earns as much at home as he wants. Much depends on it:

- experience;

- knowledge;

- software;

- jar.

Average earnings 60 thousand rubles on the stock market. Such profitability is considered good, but there are specialists who have devoted all their free time to trading and have already made millions on it.

People in the office receive from 30 thousand rubles, but it all depends on the success of the trades that the trader concludes.

For traders working in companies, their salaries can vary significantly depending on the specific position.

If we start with the salary of an American forex trader, according to Indeed, the average salary is $ 98,652 per year plus $ 25,000 in commissions. However, the highest they cited was $ 196,917.

In our country, such amounts can only be dreamed of by a person who works for himself or brings the company colossal profits.

There are a number of different positions available in hedge fund trading, such as:

- analyst;

- strategist;

- junior traders / portfolio managers;

- senior traders / portfolio managers.

Most people in a company start out as an analyst (4-8 years old) helping junior and senior traders with data, after which they move on to junior trader.

It is an industry with a high turnover rate. If a person manages a $ 50 million portfolio of assets and he earns a 10% return, his income would be $ 600,000.

The senior portfolio manager, who manages a $ 500 million portfolio and earns 10% of the profits, will receive a salary of about $ 6 million a year.

Whether you are trading on your own or for a company, performance is all a specialist has to think about. The good news is that there is an easy way to improve your trading performance, and that is learning from the pros.

Workplace

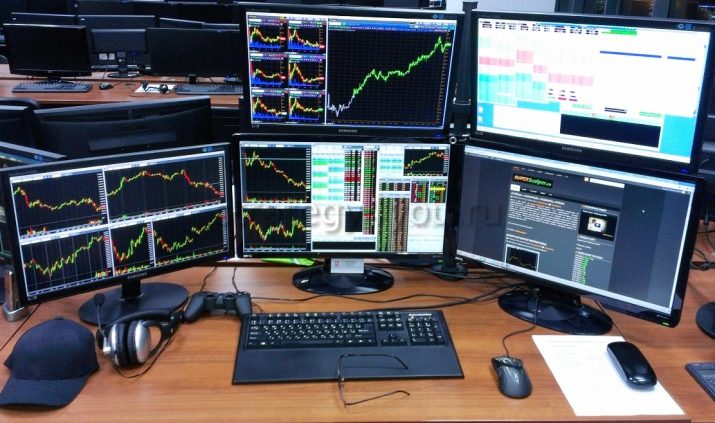

You will need personal space to conduct market trading. If this room is in a house, you need the appropriate software and a high-tech computer to monitor the market and make quick deals. A separate office is very important. This is how many people work today.

You can find work in an office and make money there, but you should understand that in this case you will have to face restrictions.